REPORT: Will the Canadian housing market crash in 2021?

If there is a housing market crash in Canada, could it be a good time to buy? Let’s take a look at what our experts had to say—and where they see house prices going.

Despite the impact COVID-19 has had on the global economy, Canadian real estate prices continue to outperform expectations and grow at a steady pace.

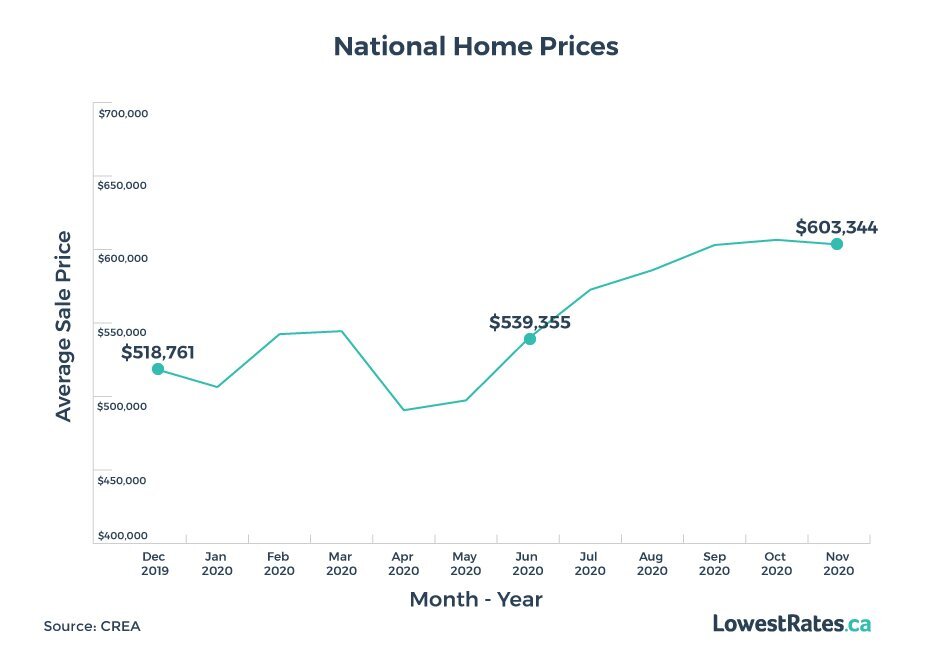

According to the Canadian Real Estate Association (CREA), national home prices were up 13.8% year-over-year in November 2020. In Ontario alone, CREA anticipates that the average home price will rise by 16.3% this year. Many experts point to historically low mortgage rates and pent-up demand as the main contributors to the surging housing market.

In a previous report, we detailed how the pandemic could affect national home prices going forward. Initially, experts were concerned this year that many homeowners could default on their mortgages as the pandemic worsened, leading to a drop in housing prices. But that didn’t end up happening. In fact, as national home prices continue to rise, the Bank of Canada is monitoring for a housing bubble. Is there any chance the Canadian housing market is going to crash in 2021?

“‘Crash’ is a very strong term to use,” says Abhilasha Singh, an economist at Moody’s Analytics. “We are expecting a modest correction. But not a crash.”

On the other hand, Hilliard MacBeth, financial advisor and author of When the Bubble Bursts: Surviving the Canadian Real Estate Crash, believes a crash has “already started.”

As a potential homebuyer, you might be asking yourself: how will things play out? And if there is a crash, could it be a good time to buy? Let’s take a look at what our experts had to say.

Key findings

- Because this is a pandemic-induced recession, economic activity is expected to rebound quickly once vaccines roll out. If that happens, it could help continue to prop up real estate prices in Canada in 2021.

- But Canadians are more indebted now than they were during the last housing crash of the ‘90s. That poses risks to the economy.

- Economic recovery will not be even across the country. Oil-producing Western provinces are facing “double trouble” with already-suffering economies due to low oil prices, and a pandemic on top.

- Calgary and Edmonton are expected to have the weakest housing markets this year as a result.

- The condo market in Toronto and Vancouver could also see more weakness this year after sales and prices there fell in 2020.

This is a recession unlike any other

It’s not uncommon during a recession to see housing prices fall. But as Singh points out, “This recession has been really different from what we have seen in the past.”

The most notable difference is that this is a pandemic-induced recession. With people being prevented for much of this year from physically setting foot in restaurants, retail stores, bars, and so on due to safety concerns — something that’s playing out again in certain parts of the country during the second wave of the virus — consumer spending has largely been paused.

“People are waiting to go out,” explains Singh. “Once that recovery comes into place we will see a sudden pickup in demand for a lot of things and services.”

Being pandemic-induced, this recession has also had a unique effect on Canada’s housing market. Instead of causing home prices to fall dramatically — and potentially crash the housing market — the pandemic has actually created a surge in demand for different kinds of housing.

Right now, the Canadian housing market is, as Singh puts it, “red hot” because of low interest rates and a change in homebuyers preferences, especially those living in metro areas.

“People are now looking to move to the suburbs so they can have bigger houses, more space, and more comfort while they work from home,” she says. “Homebuyers probably held back initially thinking that the house prices were going to crash but then found that they still had their jobs. Now interest rates are low so they think this is the right time to jump in and buy.”

Home sales in the Durham Region, for instance, shot up by nearly 50% in August 2020. And according to an August survey by Mortgage Professionals Canada, 10% of surveyed homeowners and 12% of surveyed renters indicated the currently low interest rates as their top reason for wanting to buy a home.

Singh says national home sales have recovered quickly in recent months, and are almost back to 2019 levels. The housing market is being held up in no small part by those in higher-paying jobs, who could transition to a remote work setup more seamlessly than those in lower-paying jobs could.

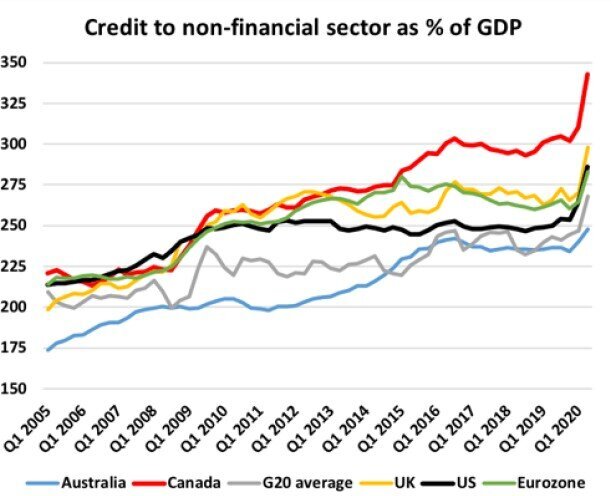

All that said, there’s still reason to be on alert because what also makes this recession unique from the last is that Canadians are much more in debt than they were during Canada’s last housing crash in 1990.

Rising debt levels could be a concern

MacBeth has written about this in his book, where he calls particular attention to the growing household and corporate debt in Canada. Since the book was published in 2015, corporations are now by some measures even more indebted than households, he says, making the next crash a much more severe risk than it was in the past.

“The household is much more indebted than it was in 1990,” says MacBeth. “The bursting of the bubble would be much more serious and will probably trigger a financial crisis. It didn't really trigger a financial crisis in 1990. It was a crisis, but not a systemic financial crisis. This one is likely to be a financial crisis.”

According to the Bank for International Settlements, a Swiss central bank, Canadians have become increasingly indebted in the last decade. While we don’t have figures dating back to 1990, the graph below shows how Canadians have become more indebted since the last recession in 2008-09.

Source: BIS.org

While the pandemic has Canadians saving more than they have since the 1960s, there’s a chance that debt could rise as the pandemic wanes. As people start to be able to leave their homes with confidence and contribute to the economy like before, “we will definitely see a pickup in the debt,” says Singh, “but not to the level that it should be concerning.”

MacBeth isn’t so sure. He says the ballooning household debt could trigger mortgage defaults. “It's quite amazing to think that somebody would continue to pay their mortgage on a condo if they're 20% underwater,” he says. “Why would they? It’s going to take two decades [to pay off].”

In fact, a recent report by Equifax Canada revealed that Canadians are back to borrowing at pre-pandemic levels. Driven by the housing market and new auto loans, consumer debt in Canada hit $2 trillion in the third quarter of 2020 when compared to the same period last year. And the average new mortgage topped $300,000 for the first time. On top of this, deferrals didn’t stop some people from borrowing, says Equifax. About 12% of new credit products were opened by consumers who were already deferring payments on existing debt.

Modest correction followed by quick recovery thanks to vaccines

While the Canada Mortgage and Housing Corporation (CMHC) stands by its pessimistic forecast that national home prices could see a steep drop of up to 21% by the end of March, Singh expects a much more modest decline of 5 to 5.5%. This is actually a slight decrease from her initial forecast of 7% made in September of last year.

“We expect home prices to fall,” says Singh. “But the recovery is going to be very quick, especially after looking at the results of the vaccines.”

When Singh initially wrote her report on the Canadian housing market, she says the biggest threat at that time was: will the vaccine be effective? “But it seems that it's quite effective,” she says now. “More than what people were hoping it to be.” Indeed, companies like Moderna and Pfizer are promising efficacy rates of 90% to 95% at protecting people from the coronavirus. And this sort of confidence is promising for economic recovery.

Once enough of the population is vaccinated, Singh expects the economy will rebound quickly. She’s not alone in that theory, either. In November 2020, Bank of Canada Governor Tiff Macklem indicated that a vaccine could cause the economy to recover much faster than expected.

“It is possible, especially when there is a vaccine, that households will decide to spend more than we have forecast and if that happens the economy will rebound more quickly,” Macklem said, according to a report from Reuters.

That said, economic recovery will not be even across the country. Singh predicts that the Prairie provinces will have a harder go with recovering due to low oil prices. “It's double trouble for them,” she says. “The housing market in the Prairies wasn’t as strong as the Toronto or Vancouver area to begin with. They already had supply issues in the Edmonton and Calgary markets, and the prices were falling. So the housing market wasn't in great condition.” Throw in a pandemic and “that adds to all the trouble in the Prairies,” says Singh.

In Singh’s September 2020 report, Calgary and Edmonton were predicted to fare the worst out of any Canadian city when it comes to national home price declines. In Calgary, a decrease of just over 10% is anticipated, and in Edmonton, a decrease of 10%.

Regina and Saskatoon aren’t far behind. Home prices in these cities are predicted to decrease by just over 9% and 7%, respectively. Halifax is the only city in the Eastern provinces mentioned in the report, and in September, predictions were for somewhere between a 6% and 7% decrease in home prices.

Singh indicated in the report that economic hardship in oil-producing provinces will only deepen. “The impact on the Calgary and Edmonton housing markets will last longer than for the rest of the nation,” she wrote.

MacBeth doesn’t share the same optimism about a quick recovery elsewhere, however. He thinks the federal government’s stimulus measures have significantly helped to stave off a crash, but says those deferral programs are over and likely won’t be repeated. This means we’re still at risk.

“My thesis was always that the next recession would trigger the crash," says MacBeth. And he believes we’re already seeing signs of trouble emerge. “It's showing up in the condo market first. There's a huge surplus in the condo market, both on condos for rent and condos for sale. And then related to that, there's a huge number of new purpose-built rentals either on the market or are about to hit the market.”

With the arrival of several COVID-19 vaccines this year, we could potentially see students return to the classroom and immigration pick up again, but it’s too soon to tell.

Will Toronto’s real estate market crash — and if so, when?

We reported in 2020 that Toronto’s housing market remained relatively unfazed by the coronavirus pandemic due to its diversified economy, booming population, and large high-income population that could easily transition to remote work. According to recent data from the Toronto Regional Real Estate Board (TRREB), the average Toronto home price jumped by 13.5% year-over-year in 2020. And economists are predicting a 5% increase in Toronto home prices by this coming spring. But as the pandemic continues to pound the city, could Toronto become vulnerable to a real estate crash sometime this year?

According to the latest figures from TRREB, November 2020 home sales in the GTA were up 24.3% year-over-year. And Re/MAX is forecasting that Toronto home prices will increase by 6% this year.

“Toronto has defied the fundamentals for a long time,” Singh acknowledges, “but we do expect prices to fall in Toronto as well. We are already seeing the rates falling and pressure already there in the condo market.”

According to TRREB, the number of new condominium apartment listings in Toronto last month was nearly double that of last year. The pandemic has created a lull in immigration and we’re no longer seeing the typical influx of international students that usually flock to condos, as many are now learning virtually. This shakeup is being reflected in condo prices, too, which were down 4.7% year-over-year in December, according to TRREB.

“Rental properties are really taking the brunt of it,” says Singh. “I could see prices falling much more in a downtown area compared to in a suburb area, but I don't expect a crash in Toronto.”

MacBeth believes there could still be trouble ahead in condo markets in major cities across the country.

“Rents have dropped a whole lot,” he says. “So monthly losses that were $200 or $300 are now probably $500 to $800. And some of the owners will have trouble with their employment. So they're going to have to face a real personal crisis in terms of what they are going to do because those condos are really hard to sell.

“That’s probably where the crisis and the crash is going to start is in those investor-owned condo buildings in Toronto, Vancouver and Calgary.”

About the authors

Zandile is a freelance personal finance journalist. She previously worked as a personal finance writer at LowestRates.ca and before that, the content editor for Real Estate Management Industry News. As a self-proclaimed budget warrior, Zandile dedicates most of her time to advocating for financial wellness.

Lisa is a senior editor in the personal finance space. Her work has appeared in Reader’s Digest, Toronto Life, Canadian Living and TVO. As a child, she diligently hoarded the $50 bills that fell out of her Christmas cards. Adult Lisa is working hard to resurrect those stockpiling tendencies.