REPORT: 10 most and least expensive vehicle brands to insure in Ontario

While vehicle brand might not be the most important detail when shopping for a new ride, the make can affect your insurance premium — for better or worse. Find out the most and least expensive car brands to insure in Ontario.

Key findings:

- On average, Nissan drivers had the most expensive car insurance rates in Ontario from 2019 to 2021, possibly due to higher claims risk or repair costs. Nissan owners paid 11% more for car insurance than the provincial average during this time frame.

- The Canadian Loss Experience Automobile Rating (CLEAR) system analyzes vehicle data to determine your potential claims costs. A good rating could result in insurance savings.

- While Nissan, Hyundai and Toyota drivers in Ontario may pay higher car insurance rates, there are still opportunities to save.

Often, the vehicle you drive reflects your lifestyle — whether you are a family person in a minivan or a top earner in a luxury sportscar. But what draws us toward a particular brand? Sometimes, it’s loyalty or a sensible price point. Maybe it’s innovation or value retention, the idea of a dream car, or simply a status symbol. The brand may even be a predetermined detail in your otherwise informed car-buying decision, next to safety features, comfort, and fuel consumption.

It may be worth a second thought, however, as the brand can also influence your insurance premium — for better or worse. We pulled data from the LowestRates.ca auto insurance quoter from January 1, 2019, to December 31, 2021, and compared the cost of the average insurance quote by vehicle brand to the provincial average to determine which vehicle makes may be costing consumers more to insure.

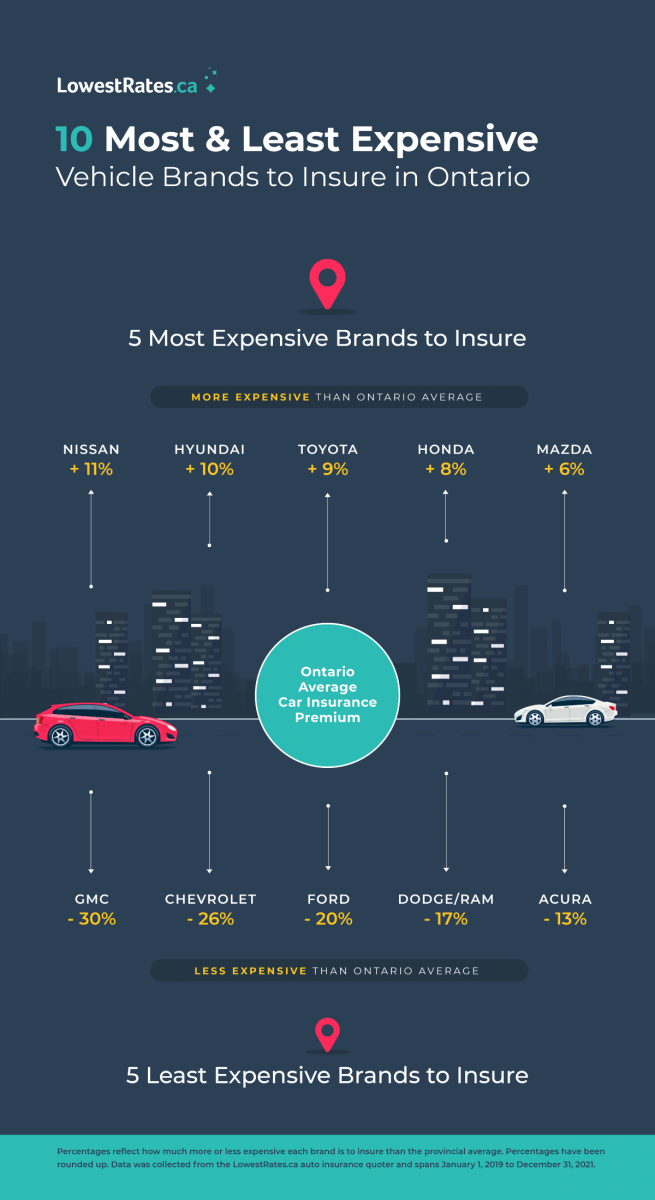

The top 10 most and least expensive car brands to insure

According to LowestRates.ca data, Nissan ranks as the number one most expensive car brand to insure in Ontario. Nissan owners pay about 11% more for car insurance than the provincial average premium for brands included in this study.

Most expensive car brands to insure:

- Nissan (11% more expensive than the provincial average)

- Hyundai (10% more expensive than the provincial average)

- Toyota (9% more expensive than the provincial average)

- Honda (8% more expensive than the provincial average)

- Mazda (6% more expensive than the provincial average)

GMC owners, on the other hand, have the cheapest car insurance and pay roughly 30% less for their policies than the provincial average.

Least expensive car brands to insure:

- GMC (30% less expensive than the provincial average)

- Chevrolet (26% less expensive than the provincial average)

- Ford (20% less expensive than the provincial average)

- Dodge/Ram (17% less expensive than the provincial average)

- Acura (13% less expensive than the provincial average)

How vehicle brand can affect your insurance rate

Auto insurance companies use several factors to calculate the premium you pay, including your driving record (a good one can go a long way in lowering your rate), insurance history, home address, age and gender — you factors.

Your vehicle, however, has a series of risk factors of its own. The Insurance Bureau of Canada (IBC) analyzes the cost of collision, comprehensive, direct compensation property damage (DCPD), and accident benefit (AB) claims using the Canadian Loss Experience Automobile Rating (CLEAR) system. Industry experts use this rating to see how claims costs affect auto insurance rates for specific makes and models.

“Insurance companies in Ontario or Alberta, for example, could use this document when they file for their rates,” says Steven Harris, licensed insurance broker and LowestRates.ca expert. “They use the CLEAR system as justification for the insurance rates that they charge on [certain] vehicles.”

Depending on your vehicle’s CLEAR performance, you may pay more or less for car insurance as a direct result of the potential costs your insurance provider is likely to incur from your particular vehicle in the event of a claim.

For instance, the 2009 Dodge Journey SXT 4DR 2WD was the cheapest car to insure in Canada for 2021, at 43.29% less expensive than the national average, according to LowestRates.ca data. Drivers of this mid-size SUV would likely see excellent insurance cost savings due to the vehicle’s performance and claims risk.

“There are a lot of other variables that go into creating a premium,” adds Harris, “but this is an important piece.”

What you can infer from your vehicle’s CLEAR

In the most recent CLEAR document, number ratings and colour codes tell a bigger story. A lower CLEAR number, or a green colour, indicates a lower claims risk, whereas a higher CLEAR number, signified by yellow or red, indicates a higher claims risk or likelihood of theft.

For example, the most recent CLEAR data suggest that the 2018 Nissan Altima 4DR ranks poorly in all four claims categories. In comparison, the 2015 Ford F-150 2WD pickup truck scores well across the board. This could help explain their respective positions on our list.

“The collision and DCPD ratings are more concerned about the cost of repair for those vehicles in those situations,” says Harris. “If you’re in a collision, how much does it cost to fix this make and model of vehicle?”

Comprehensive claims focus more on theft and other insured perils, such as fire.

“For theft, what is the propensity for this vehicle to be stolen? And if the vehicle is stolen and not recovered — a total loss — the payout can be higher on that,” says Harris. “And then you have accident benefits, and that’s injuries.”

In terms of accident benefits, pickup trucks are generally labelled “green” on the CLEAR scale. Often, larger vehicles provide better crash protection than smaller ones.

“If I’m driving a two-door or a four-door vehicle, I have a higher propensity for injury than if I’m driving a bigger truck,” says Harris. “And injury can be a very significant part of claims cost.”

This could explain why brands such as GMC, Chevrolet, Ford, and Dodge/Ram, known for their trucks, monopolize the list for least expensive car brands to insure, while SUV and car brands like Nissan, Hyundai, and Toyota dominate the list for most expensive.

How to save on car insurance no matter your vehicle make

The CLEAR is a good benchmark for how your vehicle will perform overall, but other variables also go into your insurance premium.

“You have this year-over-year data on vehicles in terms of their performance, and when IBC does its calculation, how this vehicle will perform for collision, comprehensive, accident benefits, or DCPD changes year over year as well,” says Harris. “So, just because something had a poor performance in 2020, will it have that same poor performance a year later after the new data set? Maybe. Or that variable can change.”

The best way to save on insurance, regardless of your vehicle make, is by comparing auto insurance rates annually as you come up to your renewal. While CLEAR data can change, so can those “you” factors. In the past year, maybe you gained driving experience, a traffic conviction disappeared from your record, you moved to a different neighbourhood, or a claim is no longer affecting your insurance rate.

For example, insurance providers can apply a surcharge to your insurance rate for up to six years for a collision and three years for a traffic ticket. After this time, you could be eligible for a lower insurance rate. It’s also possible that your insurance company incurred lots of claims in the previous year and filed for rate increases with the provincial auto insurance regulator. The point is: you won’t know if there is a better rate on the market unless you shop around.

Methodology

We analyzed data from the LowestRates.ca auto insurance quoter from January 1, 2019, to December 31, 2021, to determine the most and least expensive car brands to insure in Ontario. While car insurance premiums vary from person to person, we have determined how much more or less expensive each brand is compared to the provincial average using the following parameters:

- Number of vehicles: 1

- Number of drivers: 1

- Clean driving record (no collisions, suspensions, or traffic tickets)

- Age: 30-39

- Gender: Male

Save 23% on average on car insurance

Compare 50+ quotes from Canadian providers in 3 minutes.

About the author

Hayley Vesh is an editor/writer in the personal finance space. Her work has also appeared in Global News. She is passionate about financial literacy and the pursuit of knowledge through lifelong learning.

.jpg)