My immigrant parents struggled so I wouldn’t have to. But the economy had different plans

By: Stacy Lee Kong on September 9, 2019

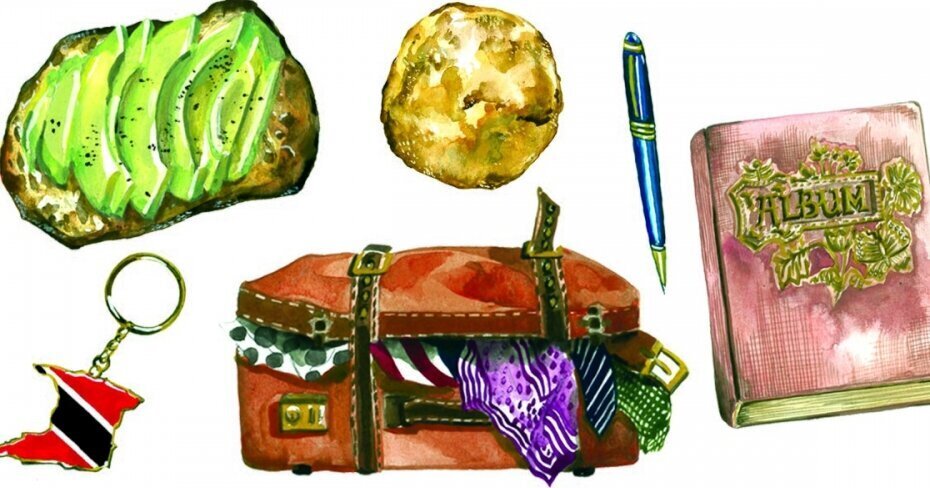

Money is a funny thing. It’s tangled up with just about every aspect of our lives — from where we live, to what we eat and the quality of our relationships — so it’s no wonder that all of us have opinions on what we should do with it. But what shaped our approach to money in the first place? What pivotal moment forever changed the way we think about our finances? To explore these questions, we’re introducing MONEY MOMENTS — a regular series where Canadians reflect on a moment in their lives that shaped their attitudes toward money.

***

My family has never had a lot of money. I don’t remember a specific moment, exactly, when I learned that we weren’t well-off. It was just something that I always knew, like the fact that we were from Trinidad, a small island in the Caribbean, or that my parents moved us to one of Toronto’s western suburbs so that we’d all have better lives. We always had the things we needed, but no one had to tell me that our Saturday night tradition of making fry bake instead of ordering takeout wasn’t just about eating food from our homeland, or that there was no way I’d be getting the $200 Tommy Hilfiger overalls that the cool girls at my elementary school were wearing. It was clear to me that there were things my family just couldn’t afford.

I assumed, though, that eventually things would improve. I saw my parents working hard — really hard — at jobs they were overqualified for. In Trinidad, my dad had his own insurance company and my mom was a secretary at the University of the West Indies. But in Canada, they worked at a recycling plant and in retail, respectively. For a long time, I believed that all their hard work and sacrifice would finally lead our family to financial freedom.

Only that’s not exactly what happened. For years, I watched them stress out over bills, mortgage payments and unexpected expenses. Add in some bad luck — my dad had a brain aneurysm when I was in elementary school and was off work for months; both parents were also laid off at different points throughout their careers — and almost 30 years later, they’re in a very similar financial situation to when they arrived.

Of course, like many immigrant parents, they knew that they may not make it, financially speaking, but they were working to give their children a better life. The thing is, I’m not sure that’s going to happen. While previous generations have successfully made that leap, it’s become harder than ever for my generation to do the same, thanks to crushing student debt, expensive housing and precarious work.

My reasons might be different from those of my parents, but it increasingly feels like struggling and uncertainty are in my future, too

Their experience has already deeply affected the way I think about money. My parents immigrated to Canada in the late 1980s for the same reason that many other people came to the country at the time and have come in the years since: they wanted me to have access to better and more abundant opportunities, and they’d already seen other family members succeed. Unfortunately, economic outcomes are rarely as favourable for first-generation Canadians as they are for their Canadian-born peers. Newcomers tend to experience higher unemployment rates, and although recent immigrants are now making more money than ever before, according to the 2016 Census, they still earn less than people who were born in Canada.

To be blunt, this has made me want to earn as much as possible. I want a better financial life than the one my parents have been dealt.

But the realities of the modern economy are getting in the way. I’m a millennial woman who lives in Toronto, a city known for being unaffordable, and who works in journalism, a field that isn’t lucrative or stable. When I was deciding what to study at university, no one knew that journalism was going to undergo a sea change (or 20) in the coming years. Or at least no one told me it would. I’ve been freelancing for the past two years, and in this increasingly precarious industry, I have no idea when I’ll have a full-time job again. My reasons might be different from those of my parents, but it increasingly feels like struggling and uncertainty are in my future, too.

Statistically speaking, I stand to make less money, have more debt and face higher housing prices than the generation before me. A recent Statistics Canada study found that millennials are relatively better off than young Gen-Xers — but home ownership was a key factor in achieving a higher net worth. And since it’ll take me about nine years to save the down payment for an average house in Toronto, that’s probably not going to happen.

My financial situation, and those of my millennial peers, is evidence that the classic immigrant narrative about each generation doing better than the last might no longer be achievable. At least not for us. And I can’t help but feel guilty — and a little pissed off. What was the point of my parents’ sacrifices if I can’t find financial stability either?

Illustration by Janice Wu.