A look at Scotiabank’s new rewards cards, including the Passport Debit Card

By: John Shmuel on September 25, 2017

Scotiabank is the latest Canadian bank to ramp up its rewards card offerings, releasing three new credit cards and a debit card.

In case you haven’t been paying attention, the Canadian credit card and debit reward space is quickly heating up. Lenders want to capture the growing segment of Canadians who use credit cards and debit cards for transactions — and demand rewards for doing so.

Scotiabank is especially touting that its new offerings include a debit card — a niche rewards space Scotiabank has clearly been trying to corner. The bank already offers a cash-back debit card and a debit card that allows users to collect SCENE points.

“Eighty per cent of consumers want to be rewarded for their business (Financial Consumer Survey 2015) and debit rewards are unique in the Canadian market,” Scotiabank said in a release.

Below is a look at the new cards, their rewards rates, and how they stack up to the competition.

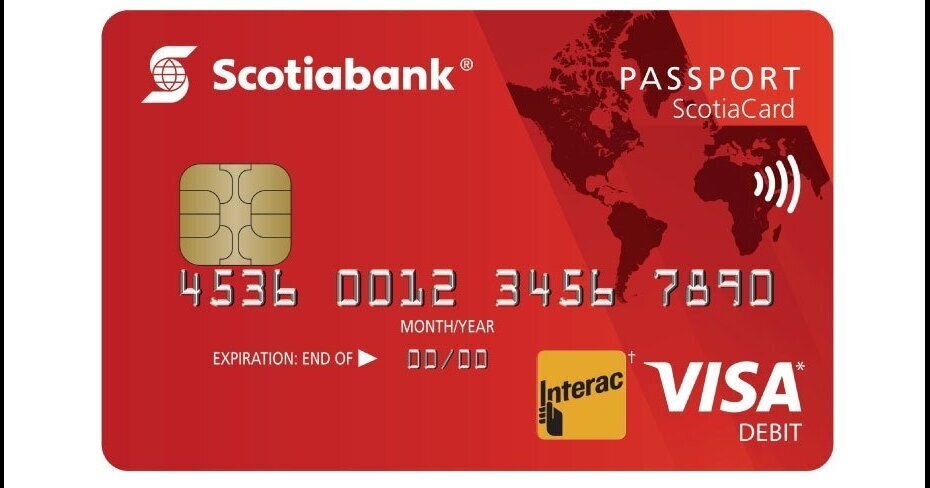

Scotiabank Passport Debit Card

- Get one Scotia Rewards for every $5 spent

- Introductory offer of up to 10,000 bonus points.

The introductory offer on this card is worth about $100 — Scotia Rewards have to be redeemed in increments of 5,000, and each point is worth roughly one cent. You can use the points to book travel, buy from an online catalogue or redeem points for credit.

Scotiabank GM Visa Business Card

- Earn 5% back in GM Earnings on first $10,000 spent

- Earn 2% on anything spent after $10,000

This card is launching in October 2017. At 5%, this is one of the richest rewards rates in Canada. GM Earnings, however, can only be used toward the purchase or lease of a GM vehicle.

Scotia Momentum Mastercard

- 1% cash-back on gas, groceries, drugstore purchases and recurring payments

- 0.5% on other purchases

- No annual fee

- No cash-back limit

It’s nice to see another option in the no-fee space, but this card’s offerings are pretty standard. It pales in comparison to something like the Tangerine Money-Back Credit Card, which offers 2% back in choice categories.

Scotiabank American Express Card

- 5,000 Scotia Rewards signup bonus

- One Scotia Rewards point for every $1 spent

- No annual fee

This card has a number of interesting offers, the major one being the signup bonus. You get $50 if you spend $500 in the first three months — essentially 10% back. It also has the equivalent of 1% back and no annual fee. And since it’s an American Express card, you get comprehensive travel insurance. (Of course, since it’s an Amex, you also get the downside of fewer merchants accepting it, making it harder to collect points.)

Compare Canada's top rewards credit cards using our comparison page.

Compare cards