Inheriting my family's financial worries shaped my attitude to money

By: Jessica Moorhouse on June 11, 2019

Money is a funny thing. It’s tangled up with just about every aspect of our lives — from where we live, to what we eat and the quality of our relationships — so it’s no wonder that all of us have opinions on what we should do with it. But what shaped our approach to money in the first place? What pivotal moment forever changed the way we think about our finances? To explore these questions, we’re introducing MONEY MOMENTS — a regular series where Canadians reflect on a moment in their lives that shaped their attitudes toward money.

***

My grandpa grew up in rural Quebec with almost a dozen siblings, a homemaker mom and a dad who was terrible with money. He wasn’t good at earning it, was even worse at spending it, and declared bankruptcy at least once in his lifetime. You know the term “dirt poor”? That’s literally how poor my grandpa was as a child. The only thing that brought him out of poverty was getting a job with the military, which he credits for saving his life. Even so, he was never truly able to shake his past when raising his own family.

As a result, my grandparents were the definition of extreme frugality. They made living below their means look like an art form, because to them living frugally was the only way to combat falling back into poverty. It was this fear of poverty that drove most of their financial decisions, which was passed onto my mom, then me.

By nature, I’m a worrier. So is my mom, and so was her dad. I’ve gotten better over the years, but I still worry about almost everything under the sun all the time. After many conversations about money with my mom, and one long podcast interview with my grandpa, I finally understand where this generational worry stems from.

You know the term “dirt poor”? That’s literally how poor my grandpa was as a child

It came from poverty, or rather the fear of poverty.

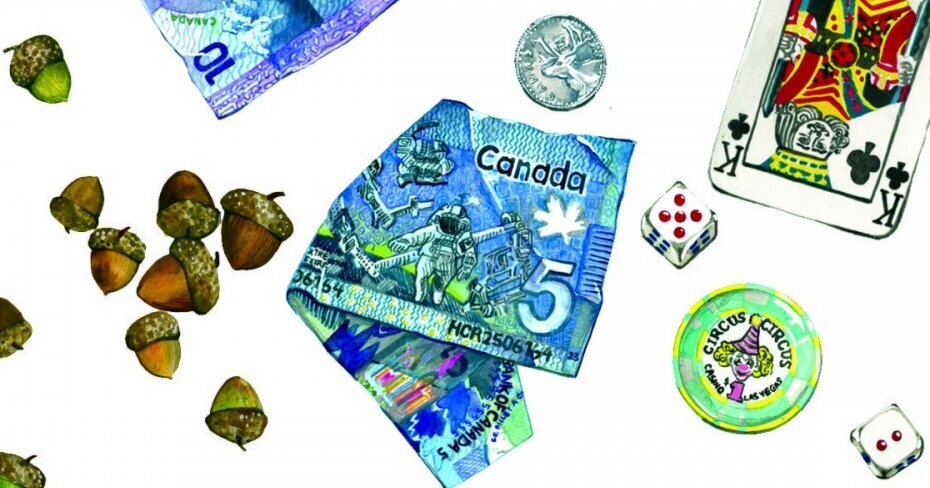

Of course, I have a different perspective than my grandpa. Because I’ve never personally experienced poverty, I can only imagine the worst-case scenario…which scares the hell out of me. That’s why ever since I started earning money at 13, I’ve been a money hoarder. Like a squirrel frantically storing nuts inside of a tree, whenever I used to get money, I’d put it straight into a savings account for safe-keeping.

This may not sound like a problem to you, but by putting all my efforts into saving, I never understand the virtues of earning or investing. I thought fixating too much on earning made me greedy, like Scrooge McDuck diving into his gold coin pool. And investing? Well, that was just a fancy word for gambling hours of hard work away.

Every single one of us makes at least one money decision a day. It could be as small as “Should I use debit or credit to buy my bus ticket?” And it could be as big as “Should I finally open up an RRSP?” No matter what decision you face, what money means to you will have a big impact on what choice you ultimately make.

It came from poverty, or rather the fear of poverty

What does money mean to me? I usually tell people that money means freedom, opportunity, and choice. But if I’m being completely honest, those concepts haven’t always been the driving forces behind my financial decision-making. What has always been a constant, however, is my never-ending search for security.

I’m happy to say that over the past 7 years of blogging and podcasting about personal finance, and eventually becoming a financial counsellor, I no longer feel guilty about earning money and don’t equate investing with gambling. What I realized is that in order to truly gain that sense of security I’ll probably always be in search of, I need to save, earn and invest. Doing one but not the others puts limitations on my potential for building wealth. And, although fear can be a great motivator, feeling in control of your money is even better.

Illustration by Janice Wu.