Financial facts that should scare you this Halloween

By: LowestRates.ca Staff on October 30, 2019

We like to be optimistic here at LowestRates.ca.

But from time to time, everyone needs a reality check. That's especially the case in Canada when it comes to our finances. There are a lot of scary numbers out there. We're carrying too much debt. Housing has gotten too expensive. We don't have enough to retire.

While it's not all doom and gloom (we have a handy money-saving guide right here!) it's important to know about the issues we just mentioned.

Below, we've rounded up the main scary financial facts that you should know this Halloween. We also asked five experts about why these numbers are so frightening.

Houshold debt

Why’s it scary? Debt — it might be more Canadian than maple syrup. Canada is one of the most indebted countries in the world, with the average debt-to-disposable income ratio in this country sitting at 177.6% as of the first quarter of 2019. That means for every $1 of disposable income someone has, they owe about $1.77 in debt.

The problem is, despite efforts by governments to try and get this down — whether instituting new housing rules or trying to regulate credit cards and pay day loans — this stubborn stat just won’t budge. Canadians are carrying more debt than ever and we’re still sitting at historically low interest rates. If interest rates were to rise, or if a recession hit, leading to job losses, all this debt could spell a lot of trouble for the country.

Why it scares the expert: "The average Canadian owes $1.77 in debt for each $1 of disposable income earned. It's an all-time record, says the Bank of Canada, and mortgages make up almost three-quarters of this debt. Even if interest rates stay flat or decline, high debt is bad for your financial health. When you stretch to make mortgage payments, you're more likely to use credit cards to cover expenses and carry a balance at double-digit rates. You're less likely to meet long-term goals, such as saving for retirement or your children's education. In the worst case scenario, you're living from paycheque to paycheque, with nothing to fall back on in an emergency. A 2019 survey by insolvency firm MNP Ltd. found that 54% of Canadians worry about their ability to repay debts, 48% are $200 or less away from insolvency each month and 40% won’t be able to cover their expenses in the next 12 months without taking on more debt. Now that’s blood-curdling."

-Ellen Roseman, personal finance columnist

Student loans

Why's it scary? The average university student in Canada graduates with more than $26,000 of debt. In the 2016–2017 fiscal year alone, the government doled out $2.6 billion in loans to students. For many, it can take between nine and 15 years to pay that debt back. The average cost of an undergraduate degree (when looking at all fields of study) has increased by 3.3% since the 2017/18 school year.

Student debt contributed to almost 18% of Ontario insolvencies filed in 2018. And it can hit women the hardest thanks in no small part to the gender pay gap. Women owe an average of 8.2% more in student debt than their male counterparts and are filing for insolvency because of that debt at a much higher rate than men.

Why it scares the expert: “These figures scare me because we may have more than one generation of Canadians who may never be debt-free. Imagine the knock-on effects of that. Fewer contributions to the tax base, to the economy, and to wealth building and savings. Many students will start off and remain debt slaves for the bulk of their adult working lives. It no longer just takes a good summer job to pay for your education.”

-Scott Terrio, manager of consumer insolvency at Hoyes Michalos & Associates Inc.

Retirement savings

Why's it scary? Fewer than a third of Canadians actually have a financial plan in place for retirement, according to a CIBC poll. And 80% of Canadians are worried that they don’t have enough money saved for that stage of their life. Millennials are in an especially precarious situation. They’re now being cautioned that in order to have a comfortable retirement, they’ll need to save twice as much each week than their baby boomer parents had to.

Why it scares the expert: “The scary thing about this statement is that it’s probably true. Boomers have been told for years that Canada has a retirement crisis but it’s really the millennials who will feel the brunt of it.”

- Fred Vetesse, former chief actuary of Morneau Shepell and author of Retirement Income for Life

Insurance

Why’s it scary: $2.1-billion: That's how much claims caused by environmental catastrophes cost Canadian property and casualty insurers in 2018, according to the Insurance Bureau of Canada (IBC). There were 12 catastrophic events last year; all of them caused major flooding. Which storms triggered the biggest payouts? A wind and rainstorm that pummeled Hamilton, Toronto, the GTA, and parts of Quebec in early May ($680-million) and a September wind and rainstorm that pounded the Ottawa-Gatineau region ($334-million). The amount insurers pay out annually for catastrophic losses has doubled since 2009.

Why it scares the expert: "It’s indicative of the impact of our changing climate,” said Aaron Sutherland, a vice-president at Insurance Bureau of Canada. “It's also indicative of the human toll. While insurers can help you rebuild, there are certain things that you can lose — memories, photographs — that we can’t replace. They’re irreplaceable." Sutherland also says the trend in claims costs "is putting a lot of pressure on the industry to find new ways to keep insurance affordable."

-Aaron Sutherland, vice-president at Insurance Bureau of Canada

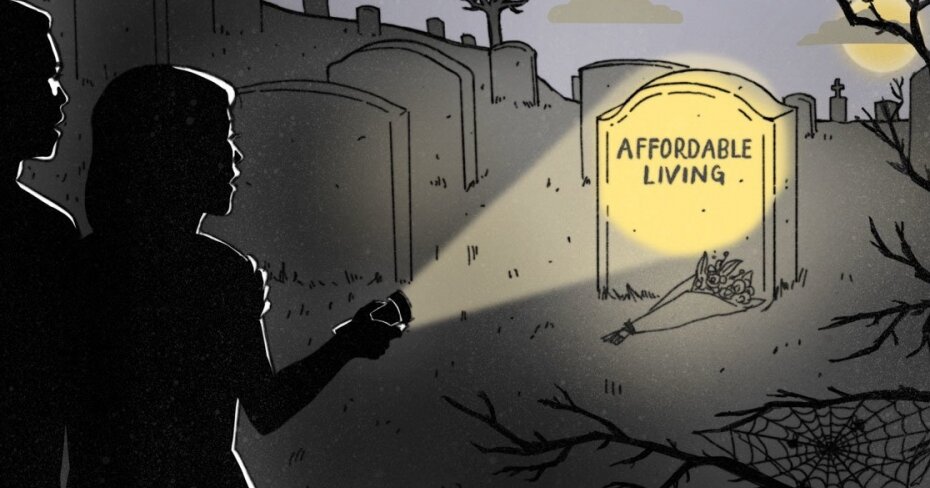

Housing

Why’s it scary? Across the country, but especially in Canada’s major cities, the crisis of unaffordable housing has only gotten worse over the past few years. Today, it takes a typical person between 25 and 34 years of age 13 years to save for a 20% down payment on an averaged priced home in Canada — compared to the five years it took when today’s aging population started out as young adults in 1976. The problem is even worse in Canada's biggest cities — it takes between 15 and 21 years to save for a home in Toronto, while in the Greater Vancouver area, it takes between 23 and 29 years. Renters are facing a similar squeeze, as a recent study states that low-income workers cannot afford to rent in 91% of Canadian cities. Mortgage broker and housing expert Shawn Stillman says the lack of affordability across both areas of the housing market is actually one vicious cycle.

Why it scares the expert: “People are at a huge disadvantage financially if they don't buy their own homes because the real estate market has gone up so much even in the last 12 months ... People have this mentality that if I don't buy a house now, I'm never gonna buy a house. They feel they're forced to buy one because they’re going to be at a disadvantage if they don’t. But, that’s probably because we also don’t have affordable housing and affordable rentals that make renting a good option. It used to be $900 to rent a one-bedroom in Toronto and now a one-bedroom is over $2,500. It’s just really gotten out of whack and wages haven’t kept pace with that. So people are feeling squished, and they feel that the only way to get out of it is to buy their own house. Not having enough rental properties is causing that issue.

“It simply comes down to supply and demand and there's more demand and supply. So really, somebody has to take the lead to improve the housing stock — by adding more density, more buildings — but Toronto's only answer has become more and more like New York where there are skyscrapers on every corner. The economics on their own are not going to solve this issue. There has to be some type of intervention to help first time home buyers if that’s the role government wants to take.”

-Shawn Stillman, principal mortgage broker at Mortgage Outlet

Illustration by Taryn Gee. Infographic by Janine Wong.