Being a child of divorce shaped the way I think about money

By: Erin Bury on December 16, 2019

Money is a funny thing. It’s tangled up with just about every aspect of our lives — from where we live, to what we eat and the quality of our relationships — so it’s no wonder that all of us have opinions on what we should do with it. But what shaped our approach to money in the first place? What pivotal moment forever changed the way we think about our finances? To explore these questions, we’re introducing MONEY MOMENTS — a regular series where Canadians reflect on a moment in their lives that shaped their attitudes toward money.

***

My parents had the best kind of divorce. They split when I was just two years old, and while there’s no “good” kind of divorce, I have memories of theirs being quite amicable. I grew up living with my mom full-time, and would visit my dad on holidays and every summer for a few weeks at a time. I had an extremely close relationship with both of them, and still do.

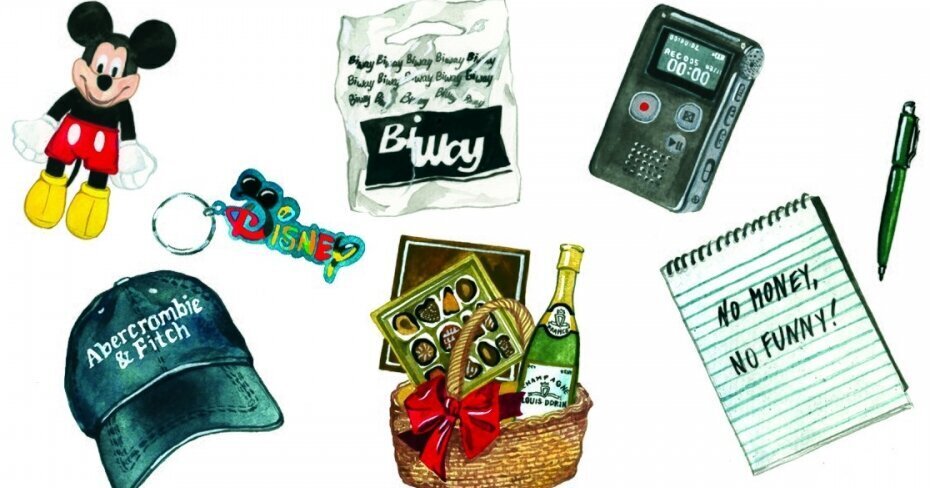

My mom worked at Nortel during its heyday. By the time I was in high school, she was a director on Nortel’s marketing team, attending global trade shows and developing ad campaigns for fancy fibre optic products. As Nortel’s stock price soared, so did my mom’s career. We went on annual vacations to places like Disney World and Bermuda; I accompanied her on business trips to Dallas, which included Abercrombie & Fitch shopping sprees; and every Christmas, giant gift baskets would show up from Nortel colleagues and clients. We weren’t rich, but I was by all accounts a very privileged upper-middle-class teenager living in Toronto’s suburbs.

My dad was a journalist who worked at the local paper in Belleville, Ont. Being a community newspaper reporter doesn’t exactly make you a millionaire, but my dad always had an amazing knack for living within his means. That’s not to say my dad was cheap, though. He was just sensible. He wouldn’t buy things he couldn’t afford on credit; he’d tell me to put on a sweater instead of turning the heat up (much to my chagrin); and he’d say things like, “You’re going to pay WHAT for that t-shirt?” or “I could buy five suits at BiWay for the price of that!” Personal finance was just so black and white for him: if you can’t afford it, don’t buy it. Period.

I easily could have been a spoiled teenager in the ‘90s — the height of Nortel’s success — who had no sense of the value of money

I suspect he inherited this mentality from his own father, who emigrated to Montreal from Poland before my dad was born. His infamous catchphrase was: “No money, no funny”, which meant that it was better to have money than live outside your means and wind up with none.

I easily could have been a spoiled teenager in the ‘90s — the height of Nortel’s success — who had no sense of the value of money. I didn’t understand things like mortgages and credit. I just understood that I got to buy nice clothes and go on cool trips. But being a child of divorce gave me the chance to see how life looked on two vastly different career paths. Some might think that growing up in two households puts children at a disadvantage. I credit it to why I developed a realistic and healthy view of money.

My mom’s career (and the perks that came along with it) instilled in me ambition and a strong work ethic. I saw how much hard work went into sustaining the lifestyle she provided for us — the long hours and the routine exhaustion from business trips — and how she busted her butt so we could enjoy the fruits of her labour. She taught me to always strive for more in my own career, and showed me the value of spending money on seeing the world (travel has become one of my passions, and really the only thing I care to spend money on). Her experience also taught me the importance of equity and, unfortunately, what happens when you have stock options and the stock tanks. Nortel's great fall taught me the importance of having a solid professional network for when you suddenly need to find a new opportunity, and not to rely on stock options for future savings.

Some might think that growing up in two households puts children at a disadvantage. I credit it to why I developed a realistic and healthy view of money

Alongside those lessons, my dad taught me the importance of maintaining a healthy work-life balance, and the importance of doing something that you absolutely love. He also taught me that the sexiest financial strategy is to live within your means (see: “no money, no funny”), and to be happy with what you have instead of always wanting more. While my mom’s job was cool because of the built-in travel and perks, my dad’s was cool because he was an amazing storyteller (a career I myself briefly pursued after getting my journalism degree in 2007.) Plus, he was lowkey famous in Belleville. We couldn’t go to a restaurant, the mall, or even a Tim Hortons without someone recognizing him.

Both my parents taught me the value of hard work.

Today, my mom has her own communications consultancy, and my dad is head tour guide at my company, The County Wine Tours. I’ve long aspired to be like both of them, and hopefully I’ve achieved that. I’m an entrepreneur who is constantly striving for more in my business, but I’m also constantly reminding my husband (and myself) that true happiness is wanting what you already have.

When they split, one of the promises my parents made to each other (and, by extension, me) was never to disparage the other in front of me. They kept good on that promise, although I do recall one time when I was about six years old and my dad said I couldn’t go for another ride on the merry-go-round at the fair because “Your mom took all my money.”

We laugh about that all the time now.