Comprehensive insurance guide 2020 (free quotes)

By: LowestRates.ca Staff on October 29, 2020

Owning a vehicle comes with significant financial and personal risks, and not having comprehensive insurance will add unneeded stress. Net claims incurred by the Canadian auto insurance industry were more than $17 billion in 2018, and fatalities topped 1,840 in 2017. Those are staggering statistics.

To mitigate these dangers, many insurers offer comprehensive coverage. But what is it? What does it cover? And should you buy it?

Here we provide answers to these questions and more.

What is comprehensive insurance coverage?

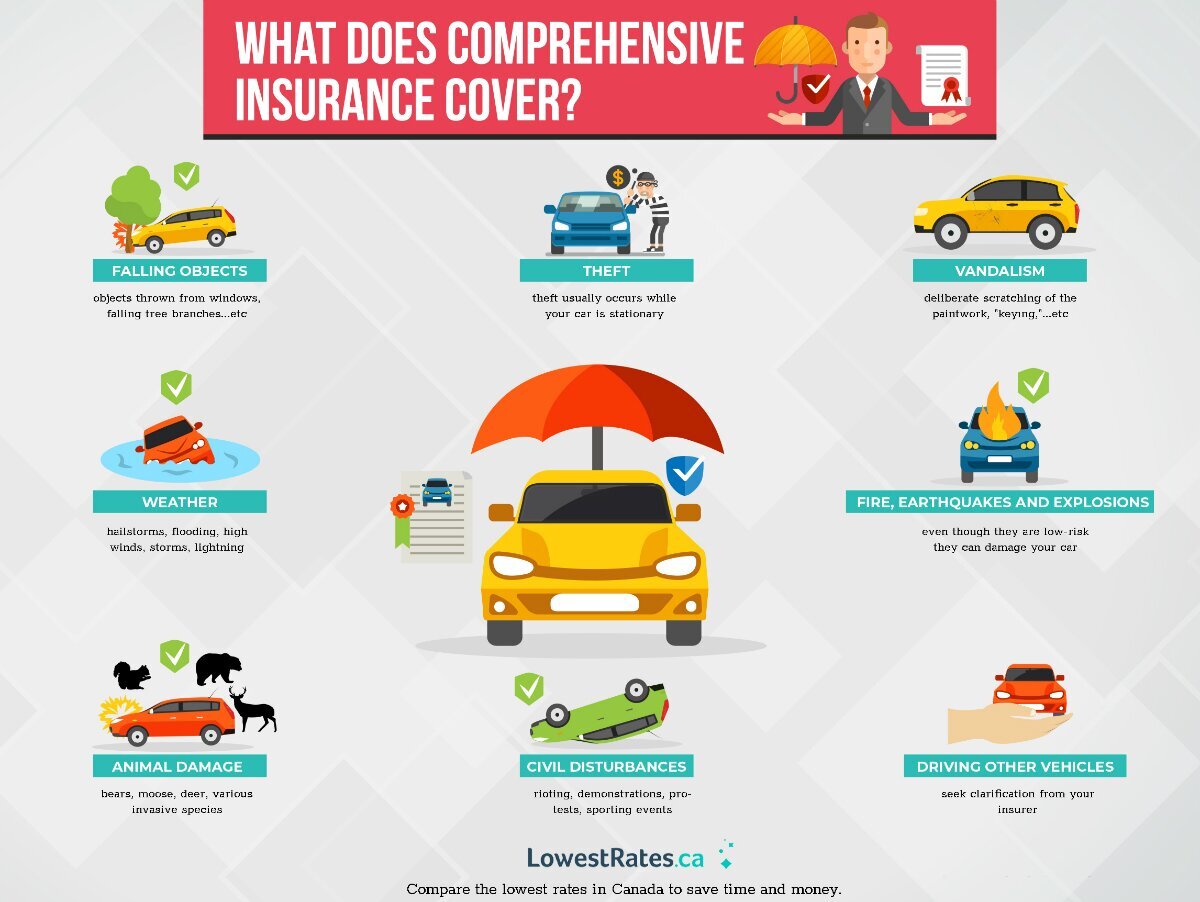

Comprehensive insurance protects you from losses that occur while your vehicle is stationary. Your insurance company will pay for the repair or replacement of your vehicle from damages such as falling objects, theft, vandalism, weather, fire, earthquakes, animal damage, and civil disturbances.

That said, the precise definition of comprehensive car insurance coverage differs from one insurer to another.

Suppose that you leave your car parked on the street over the weekend, and somebody steals it. In this event, a comprehensive insurance policy could cover the vehicle's replacement cost if the police cannot recover it.

Please note that "comprehensive" doesn't mean that insurance covers every way you could incur loss regarding your vehicle. It merely refers to a set of pre-defined risks that you face while your car is stationary (such as theft). The terminology can be confusing, so always double-check your policy before concluding what is and isn’t covered.

Comprehensive insurance: is it worth it?

When you lease or finance a vehicle, the leasing company will almost always require you to take out comprehensive insurance as part of company policy. If, however, you own your car outright, comprehensive coverage is optional. But is it worth it?

When considering comprehensive insurance, ask yourself if you could afford to replace your vehicle if it were stolen or damaged. Be honest about your capacity to cover repair and replacement costs. For instance, could you pay for new bodywork or bumpers out of pocket?

If you can't, then comprehensive auto insurance could be for you. Here, the insurer will pay out up to the pre-agreed insurance limit for any replacement or repair costs you incur. Typically, this will be your vehicle's cash value — the amount you could sell it for if you put it on the market today.

The reason insurers choose this limit is to avoid paying for uneconomical repair work. If you can replace a damaged vehicle like-for-like for less than the repair cost, it doesn't make sense to take it to a mechanic.

For instance, suppose that a hail storm damages your vehicle’s windows and destroys large sections of its bodywork (like this one). If replacing the panels costs more than the vehicle's value, the insurance company will simply cut you a check for its cash value. Once you receive the money, you're then free to use it as you please.

If you want to buy a new car that costs more than your insurance reimbursement's cash value, you'll need to pay the remaining balance out-of-pocket. So, for instance, if your vehicle is worth $15,000, but you want to replace it with a model with an RRP (recommended retail price) of $25,000, you'll need to pay the remaining $10,000 yourself.

Whether comprehensive coverage is worth it also depends on the particular risks that your vehicle faces. For instance, if you live in an area where wild animal damage is typical, it makes sense to purchase comprehensive coverage. A deer could spring out into the road at any time, causing a collision that necessitates substantial repair work to the front of your car. Paying for work out-of-pocket might be prohibitively expensive. So being able to claim for repairs offers you a way of keeping your vehicle on the road in the event of an accident.

Similarly, suppose you live in a neighbourhood with a high rate of crime. If so, there's a significant chance that somebody might vandalize your vehicle. Again, you may not have the money to pay for repairs out-of-pocket, so it makes sense to take out comprehensive auto insurance. By doing this, you transfer risk from yourself to your insurer, giving you peace of mind.

Most people face at least one of the additional risks that comprehensive coverage protects against, and often several. Whether it’s worth taking out a policy is very much a personal choice, but most drivers carefully consider the pros and cons. The advantage is that it protects you against common and costly risks. The downside is that you may have to pay higher premiums. An easy way to decide if comprehensive car insurance is right for you is by getting a free online quote. This will allow you to compare the best comprehensive car insurance quotes from a number of different insurance providers.

What does comprehensive insurance cover?

Comprehensive coverage offers protection from specified perils that weren't caused by a collision, meaning that your insurer will cut you a cheque for a range of "specified perils," otherwise known as third-party events that include a range of scenarios the insurer states explicitly.

So what events do typical comprehensive insurance policies cover?

- Falling objects. This could include waste thrown from windows and balconies above your parked car, aircraft components shed during flight, or falling tree branches.

- Theft. Auto theft is usually something that occurs while your car is stationary, and you are not present. Thus, third-party insurance does not cover it. Comprehensive insurance typically offers victims the cash value of their stolen vehicle, up to a pre-specified threshold.

- Vandalism. Vandalism includes deliberate scratching of the paintwork, "keying," smashing headlights and windows and, occasionally, damaging tires.

- Weather. Many comprehensive insurance policies cover you against damage caused by adverse weather events. Hail storms are the stereotypical example, but damage from flooding, high winds, storms, and lightning can all require repairs.

- Fire, earthquakes and explosions. Fire, earthquakes and explosions may sound like low-risk events, but they can damage your vehicle. Furthermore, many insurers require that you have specific coverage for these events. Strictly speaking, earthquakes, explosions and fires are not weather events. They usually don’t fall into the falling objects category. So if they aren’t listed on your policy, your insurance company may refuse to pay your claim.

- Animal damage. Canada is home to several animal species capable of damaging vehicles, including bears, moose, deer, or squirrels. For this reason, most comprehensive insurance policies offer "animal coverage," which pays out whenever animals damage your vehicle, whether it was in motion or stationary.

- Civil disturbances. Civil disturbances, such as rioting, can lead to significant property damage. Demonstrators and criminals will often target vehicles, burning them or smashing their windows. Civil disturbance coverage protects you against these sorts of events, and reimburses you up to your vehicle's cash value, depending on the extent of the damage.

- Driving other vehicles. Some comprehensive coverage policies allow you to drive other cars without taking out separate insurance. However, you must seek clarification from your insurer before you hop into the driver's seat of your friend’s car. The coverage may only apply to specific vehicles or in a particular geographic region.

The above list is by no means exhaustive. Be sure to talk to your insurance company if you are unsure about what is covered in your comprehensive insurance coverage.

What is not covered by comprehensive insurance?

Despite the name, comprehensive coverage does not cover all the possible ways you might incur losses on the road, particularly those you incur while the vehicle is in motion. Here are some examples of what is not included under comprehensive coverage:

- Damage from a collision on the road. Comprehensive auto insurance does not, by itself, cover losses arising from collision with another vehicle or object on the road. For instance, you cannot make a claim via the comprehensive portion of your insurance policy for repairs you require following a collision with a bollard in a parking lot. Also, you can't claim if another driver bumps you from behind while waiting at stop lights. You can only claim if you have third-party or collision coverage, which we discuss in more detail below.

- Medical expenses. Comprehensive policies do not cover medical costs that arise as a result of a collision. If you want to cover for this, you'll have to seek alternative products.

- Lost income. Car accidents can lead to time off work, disability, brain damage and permanent disfigurement — all of which reduce your income-generating potential. Comprehensive insurance does not cover losses such as these. If you want coverage, you'll need to seek out alternative forms of insurance.

- Damage to another person's vehicle. Comprehensive insurance does not cover any losses arising from a collision. Thus, you cannot make a claim under the comprehensive part of your insurance for damage you cause to another person's vehicle. Again, you need separate coverage for this.

- Legal fees. Sometimes, you may incur legal costs after an accident. You can get coverage for this, but insurers don’t regularly include it in their comprehensive insurance bundles.

Please note that you can still get coverage for these potential losses. However, you will need to take out additional forms of insurance, many of which you receive automatically when you take out auto insurance.

Is comprehensive insurance mandatory?

Comprehensive insurance in Ontario and the rest of Canada is not mandatory. In fact, insurance providers in most provinces do not include it automatically with collision coverage. You must request it as an extra. Please note that some regions may require you to take out more coverage than others.

Before taking out comprehensive insurance coverage, you should think carefully about whether you can afford to repair or replace your vehicle if it is damaged or stolen. If you rely on your car to get to work or conduct your business, comprehensive insurance should be considered essential.

How does a comprehensive insurance claim work?

If your vehicle is damaged or stolen in a way that falls within the bounds of coverage offered by your comprehensive policy, you will need to file a claim. The process, however, involves several steps. In this section, we provide a guide to help you navigate the process.

Step 1: Read the Automobile Insurance Policy in your province

According to the Financial Services Regulatory Authority of Ontario (FSRA), you should read through your province's automobile policy before calling your insurer, agent or broker. A document that outlines your rights and responsibilities regarding purchasing any insurance product. Most people find it easier to navigate the comprehensive insurance claim process once they understand their provider's obligations and their own responsibility.

Step 2: Inform your insurance company about your claim

If you discover that your car is stolen or was damaged while stationary, you should report this to your insurance provider within seven days of the event.

When you call your insurance provider, agent or broker, you'll need to have the following information on hand:

- The vehicle's registered owner (your name if the damaged or stolen car is yours).

- The make, model and registration year of the vehicle.

- The licence plate number.

- The time, date, and location you discovered the damage or that the car was missing.

- A description of the events.

- The nature of the damage to the vehicle.

- The name and badge number of the police officer conducting investigations if someone stole your vehicle.

Step 3: Your insurer processes your comprehensive insurance claim

Once you make a claim, your insurer will process it according to their internal metrics. If your vehicle is damaged, your insurer will decide whether to repair it or declare it a "total loss." Insurers will sometimes use the term "actual cash value" when discussing your insurance claim. This figure refers to the cost of replacing your vehicle with an identical model of the same age, mileage, and overall condition. If your car's actual cash value is higher than the cost of repairs, they'll send you to a mechanic. If the value is lower, you'll receive a cheque in the mail equal to your vehicle's value before the damage occurred.

If you’ve had recent work carried out on your vehicle, you may wish to mention this to your claims adjuster, along with sending them any invoices or receipts you have. For instance, if you just installed a new drivetrain, this could increase your vehicle's value by several hundred dollars.

Sometimes, insurance companies will declare your vehicle a total loss there and then. (For instance, if an earthquake destroyed it). Other times, they'll weigh the costs of repair work and then provide you with a decision, usually within 48 hours of contacting them.

Step 4: Check that the cash settlement is fair

Once you report all the details of your vehicle's theft or damage, you should receive a cash settlement. You can use this lump sum to either repair your car or replace it outright, depending on your insurer's recommendations.

Sometimes, though, the cash settlement you receive may not seem fair. You may notice, for instance, that it doesn't cover quoted repair prices no matter which mechanic you visit. Or you might not have enough money to replace your vehicle with an identical model.

If you discover this, record price information from at least five auto body shops, calculate the average, and submit relevant documents to your insurer. The insurance company's claims adjuster will then determine whether the amount of money you receive should be higher.

Usually, your provider will take note of the evidence that you provide and increase your payout accordingly. However, if they don't, you can settle the matter via an appraisal under the Insurance Act. Here, you make a formal request for an assessment in writing, stating whether you want proceedings to involve you or not. Both parties then appoint an appraiser to negotiate on their behalf. The appraisers attempt to negotiate a deal to the satisfaction of everyone. If they reach an agreement, then they determine how much money you receive. If they can't, they agree on appointing an independent umpire to adjudicate the case and provide a final decision.

Step 5: Get your vehicle repaired

Most comprehensive insurance providers allow you to get your vehicle repaired at a repair shop of your choice. However, many also keep a list of "preferred" repair shops, which are regularly audited mechanics in their network that they trust to carry out work to a certain standard. In general, you're better off going to one of these shops because it’s then the insurer's responsibility to repair the vehicle to a high standard.

Under the terms of comprehensive coverage, your insurer's responsibility is to return your vehicle to its undamaged state. However, in many cases, repairing your car leads to "betterment," meaning that it is better than before the damage occurred. It is not the insurer's responsibility to improve your vehicle, so they may ask you to contribute financially in these situations.

Suppose, for instance, that a hail storm destroys a front windshield that already had a crack. In this circumstance, you may need to pay an extra premium to cover the improvement. Similarly, if vandals damage a previously rusty wheel arch, your insurer may ask for a financial contribution toward a brand new one.

Some insurance companies may use mechanics who use "aftermarket" parts that exceed the quality of the original equipment manufacturer — particularly if you own an older vehicle. In these cases, most insurers will forgive any betterment you receive, but they may reserve the right not to.

Comprehensive insurance vs. collision insurance

Collision coverage pays for damage to your vehicle resulting from a collision between it and another car or object on the road. Collision coverage, therefore, mostly applies after an accident.

As discussed, comprehensive coverage comes into play when you incur auto-related losses while your vehicle is stationary, such as weather damage, theft, vandalism, and fire.

Collision coverage applies to the following events:

- Damage resulting from a collision with another vehicle

- Damage that comes from colliding with an object, such as a bollard, fence, sign, lamp post, wall or column

- Single-vehicle rollover accidents where the vehicle tumbles onto its roof, sometimes several times

Collision coverage does not cover:

- Theft of your vehicle

- Falling objects

- Fires

- Damage caused by animals

- Damage caused by natural disasters

Both collision and comprehensive coverage come with a deductible and will pay out actual cash value (unless you have a depreciation removal policy add-on). Collision and comprehensive coverage are optional if you own your vehicle outright but are required when you’re leasing or financing.

Importantly, neither collision nor comprehensive insurance cover damage to another person's vehicle, nor the medical bills of any parties involved.

Comprehensive deductible auto insurance: what is it?

A comprehensive deductible in auto insurance is the amount you must pay toward your claim before receiving any additional money from your insurance provider. Insurance companies offer deductibles for several reasons.

First, they help deal with the problem of what economists call "moral hazard." If drivers know that their insurers will pay out for any damage done to their vehicles free of charge, they will be more willing to put them in dangerous situations. For instance, motorists might be more inclined to leave their cars parked overnight in crime-ridden neighbourhoods if they know they can replace them at zero personal cost.

By contrast, when drivers know that they must pay a significant fee to get their vehicles repaired or replaced, they are much more likely to take care of them. Therefore, deductibles help reduce premiums for everyone. The less money the insurer has to payout, the lower the rates they can offer. In general, you can expect to pay the full deductible for comprehensive coverage, except for the specific cases outlined below.

Deductibles also help insurers offer customers a range of prices. People can choose to pay higher monthly premiums in exchange for a lower deductible or vice versa. Those who keep their cars in safe places will usually opt for a higher deductible because they know the likelihood of making a claim is low. Similarly, those who expect their cars to incur damage will typically opt for lower deductibles and higher premiums.

But how does it work in practice? Let's say that vandals damage your car and cause $5,000 worth of damage to the bodywork. If you have a $500 deductible attached to your comprehensive auto insurance policy, you'll need to send your insurer $500 before they agree to finance the repair work. The same would happen if weather harms your vehicle. If your deductible is $1,000, then your insurer will request this money before financing any repair work on your behalf.

It often makes sense to get your insurer to pay for repairs if the cost exceeds the deductible. For example, it might cost $1,500 to replace all your windows and windshield following a hail storm. If your deductible is $500, getting the insurance company to cover the costs makes economic sense. You're saving $1,000.

However, if the cost of replacing a windshield is $250 and your deductible is $500, then it doesn't pay to go to your insurer. You're much better off paying for the work out-of-pocket.

The average comprehensive deductible is between $300 and $500. Most people pay anywhere from $250 to $1,500. Please note that options do not vary a great deal from policy to policy. Some insurers offer fixed deductible increments, such as $300, $400, $500, etc. Others let you set the deductible and then run it through actuarial software to churn out a risk-adjusted premium custom fit for you.

How to buy comprehensive insurance

When considering taking out comprehensive insurance, you should first calculate whether it is worth it. Sometimes, people take out coverage that they don't need or that leaves them worse off financially.

Consider the depreciated value of your vehicle, minus your deductible. If you have an old car, it may not be worth taking out this kind of coverage at all. For instance, suppose your vehicle's value is $1,250, and your deductible is $1,500. In this case, you're automatically losing money right off the bat. It’s cheaper to replace your vehicle out-of-pocket than get your insurer to provide you with the actual cash value.

How much is comprehensive insurance?

To determine whether taking out comprehensive coverage is worth it, perform the following calculation:

- Subtract your deductible from your car's cash value

- Subtract the cumulative costs of your comprehensive coverage premiums (usually six to twelve months)

It’s hard to know for certain what the probability of a total write-off might be. When all calculations (from above) are made the final figure is your net balance. If the number you wind up with is positive, then it might be worth getting coverage.

For instance, suppose that your car is worth $1,250, your deductible is $500, and six months of premiums costs you $250. If there is a strong chance that you’ll have to make a claim, your expected gain is $500 ($1,250 - $500 - $250). If the probability of a claim is very low, the expected payoff would be much lower. You might want to take your chances but remember that no one expects to make a claim.

Once you've considered your minimum insurance requirements, you should review your existing policy. Find out how much it costs, whether the details are accurate, and whether your risks have gone down since your last negotiation.

Take a look at your driving record to see how many tickets you've received recently and how much that will affect your premiums. If you haven't incurred any fines or driving offences, your premiums won't go up. Furthermore, the longer you go without getting a ticket, the more past infractions will fall off your record, lowering your premiums.

Get comprehensive car insurance quotes now

The next step is to solicit competitive quotes. Insurers tend to vary considerably in how much they charge customers. You can either fill out forms on individual vendor sites manually or use price comparison tools like this one, saving you time and effort.

Please note that you should review both the policy's quality and the company before locking in. While some insurance companies will offer what seems like competitive quotes, their policies may lack the coverage types that you need. Furthermore, going with an unknown and potentially unreputable insurer might not be advisable. Going with a name you know, however, for a few extra dollars can provide peace of mind.

Lastly, be sure to review your policy. Check that it’s correctly priced and offers all the features that you need. If you're switching providers, be sure to cancel your old comprehensive car insurance, so you don't wind up paying double.

.jpg?itok=88nBkwga)

.jpg?itok=W5fSKczJ)